CAPITAL STRATEGIST for ENTREPRENEURS Who Deserve a Yes

I’m Steve Royster (NMLS #872502) — a Capital Strategist with Capital Lending Corp. (NMLS #168832).

I help small businesses turn real operating performance into a funding strategy that lenders can underwrite — even if you’ve been overlooked before.

MAIN STREET’S MISSING MIDDLE

There’s a whole tier of high-performing small businesses generating $1M–$10M in revenue that fall into the gap between traditional banks and alternative lenders.

Strong operators, real cashflow, real demand — but filtered out because the system wasn’t built around how you actually run your business.

I serve this missing middle, translating your business reality into a clear, credible capital narrative that lenders can say yes to.

I WORK WITH ENTREPRENEURS WHO ARE:

Established

Running a proven business with steady revenue

GROWInG

Ready to expand, renovate, acquire, or upgrade.

Collaborative

Clear on demand but need help structuring capital request.

INDUSTRIES OF FOCUS

Restaurants

*

Retail

*

Trades

*

Manufacturing

*

Automotive Repair

*

Creative Studios

*

Restaurants * Retail * Trades * Manufacturing * Automotive Repair * Creative Studios *

MY JOB IS TO CREATE A clean, credible, lender-ready deal that receives a serious look — not an automatic decline.

-

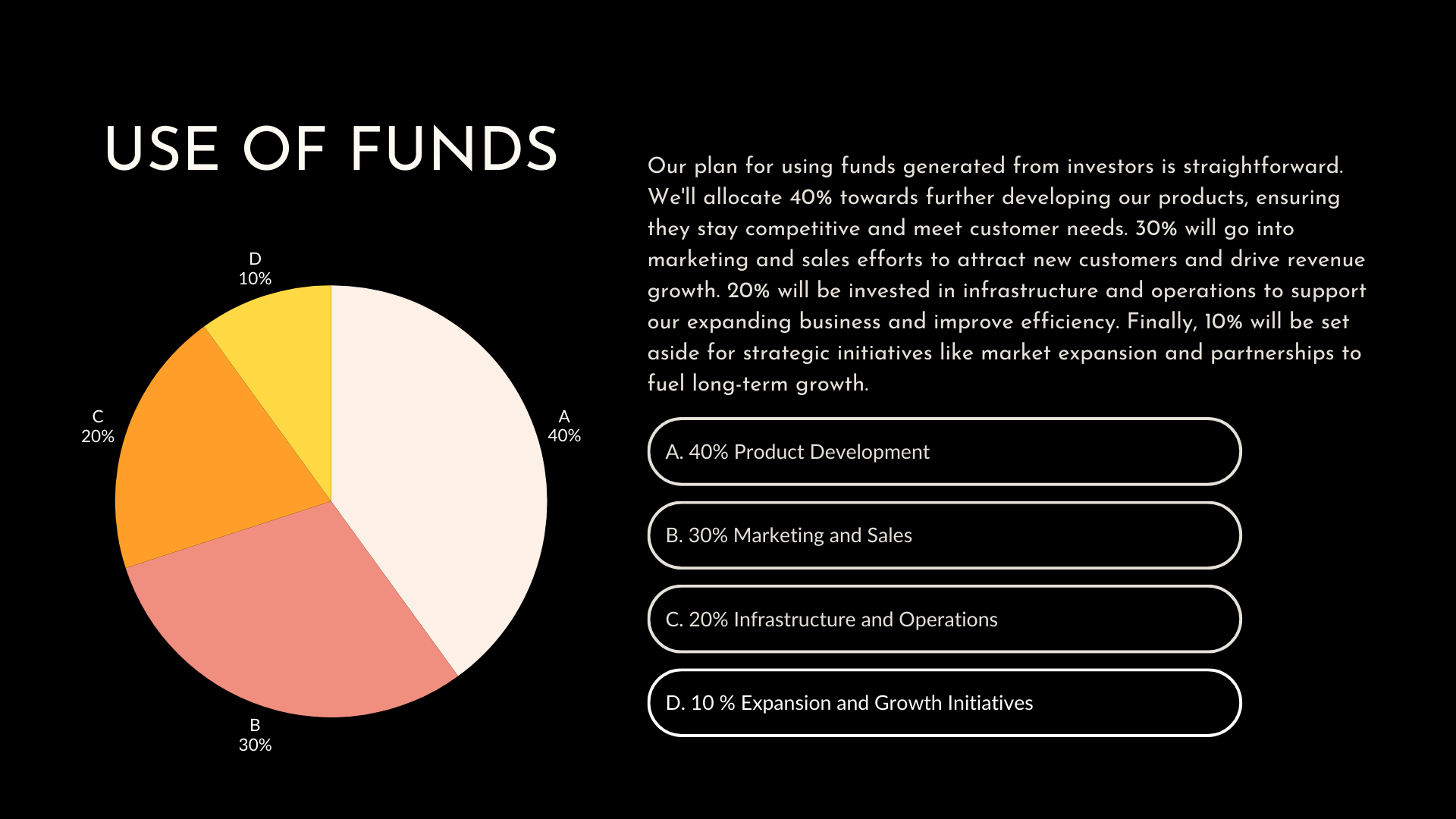

Clarify your use of funds, growth logic, repayment path, and risk mitigants. Build a lender-ready story anchored in real operations.

-

Convert your cashflow, bank activity, margin consistency, and customer demand into a clear picture lenders can evaluate.

-

I’m a Capital Strategist at Capital Lending Corp (NMLS: 168832). CLC is a New Jersey–based correspondent mortgage lender with a 30-year track record of providing residential, commercial, and business financing. Founded in 1995, the company has remained committed to serving underserved borrowers and overlooked communities while expanding from local residential lending into national and international commercial and business finance. Today, CLC continues to operate with the same transparent, no-upfront-fee model that has guided its work since inception.

WHY WORK WITH ME?

I’ve spent my career working alongside the kinds of businesses that keep local economies alive — the places that may not make headlines, but absolutely make neighborhoods work. I understand operators, not just spreadsheets.

As a Capital Strategist with Capital Lending Corp (NMLS: 168832), I’m committed to helping underserved entrepreneurs secure the funding and resources they need to grow.

Capital Lending Corp (CLC) is a New Jersey–based correspondent mortgage lender with a 30-year track record of providing residential, commercial, and business financing. Founded in 1995, the company has remained committed to serving underserved borrowers and overlooked communities while expanding from local residential lending into national and international commercial and business finance. Today, CLC continues to operate with the same transparent, no-upfront-fee model that has guided its work since inception.

Financing built around how your business actually runs.

Typical FUNDING sizes: $200K–$10M

Expansion, renovation, equipment

Working capital for seasonal or growing demand

Franchise or location acquisition

Inventory or purchase-order financing

Partner buyouts

Owner-occupied real estate

Growth capital for mission-driven startups

NO UPFRONT FEES.

WE GET PAID WHEN YOU GET FUNDED.

Step 1: Capital Readiness

Take a quick assessment so I can evaluate fit and understand your goals.

Step 2: Strategy Call

We align on use of funds, growth logic, and what lenders will want to see.

Step 3: Capital Narrative

I turn your operating performance into a lender-ready capital story.

Step 4: FUNDING Match

Your deal is placed with lenders who fund companies like yours.

Step 5: Closing Support

I help you navigate underwriting, conditions, and final terms.

START HERE

Let’s talk abiout your goals, numbers, and growth plan.